Table of Contents

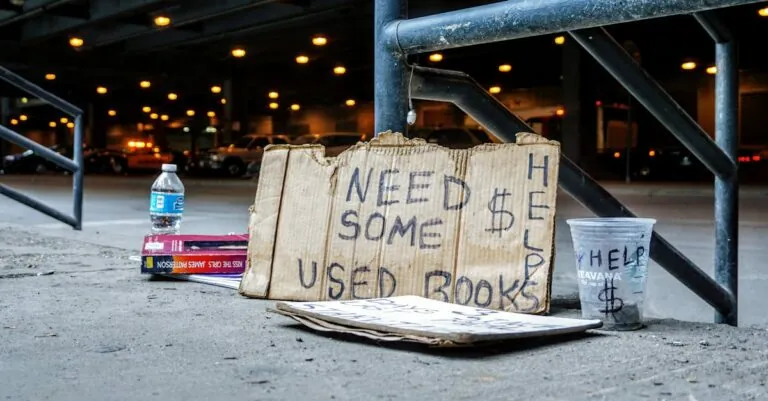

ToggleIn a world where avocado toast and artisanal coffee reign supreme, the broke millennial phenomenon has become a relatable punchline. Struggling to balance student loans, rent, and the occasional impulse purchase of overpriced lattes, this generation finds itself navigating financial chaos with a sense of humor. It’s not just about being broke; it’s about mastering the art of living lavishly on a shoestring budget.

Understanding The Broke Millennial Phenomenon

The “broke millennial” phenomenon describes a generation facing unique financial challenges. Often characterized by creativity, millennials find ways to enjoy life while navigating living expenses and debt.

Defining The Broke Millennial

A broke millennial typically refers to individuals born between 1981 and 1996 who experience financial instability. This group often struggles with student debt, which averages about $30,000 for borrowers. Many millennials encounter high housing costs; in major cities, rent can consume more than 30% of their income. Despite these challenges, a broke millennial embraces budgeting as a lifestyle. They prioritize experiences over possessions, seeking affordable entertainment and dining options, like food trucks and local markets.

Societal Factors Contributing To Financial Struggles

Various societal factors amplify financial struggles for millennials. Rising student loan debt has significantly impacted their ability to save. The average millennial earns about 20% less than previous generations at the same age, effectively limiting wealth accumulation. High living costs further exacerbate their financial conditions; rent increases outpace wage growth in many urban areas. Additionally, job market instability creates uncertainties, leaving many in part-time or gig positions. A cultural shift towards valuing experiences, however, prompts millennials to innovate and prioritize creative solutions while budgeting effectively.

Key Financial Challenges Faced By Broke Millennials

Broke millennials encounter various financial hurdles that strain their budgets. Understanding these challenges provides insight into their everyday experiences.

Student Loan Debt

Student loan debt remains a significant burden for broke millennials. On average, they graduate with about $30,000 in loans. Monthly payments can take up a substantial portion of their income, hindering their ability to save and invest. Loan forgiveness programs and income-driven repayment plans exist, yet many still struggle to navigate these options. Consequently, this debt often leads to delayed major life decisions, such as buying a home or starting a family.

The Impact Of High Living Costs

High living costs exacerbate the financial strain on millennials. Housing expenses consume over 30% of their income, leaving little for savings or discretionary spending. Grocery prices and transportation costs continue to rise, further tightening their budgets. Dining out and entertainment also contribute to financial stress, despite their preference for experiences over possessions. As rents and everyday expenses climb faster than wages, broke millennials seek creative solutions to stretch their dollars.

Coping Strategies For Broke Millennials

Broke millennials find ways to navigate financial hurdles through effective coping strategies. Certain practical approaches can enhance their budgeting and income opportunities.

Budgeting Tips

Tracking expenses clarifies spending habits, helping millennials prioritize needs over wants. Utilizing budgeting apps simplifies monitoring finances in real time. Setting realistic limits for discretionary spending fosters discipline and encourages savings. Allocating funds each month to essential categories, such as housing and groceries, ensures responsible management. By reviewing budgets regularly, they can adjust allocations based on changing needs or goals.

Alternative Income Streams

Exploring side hustles can supplement main income sources effectively. Freelancing in skills like graphic design or writing offers flexibility and additional revenue. Selling unused items online declutters spaces and generates cash. Participating in the gig economy, such as ride-sharing or food delivery, provides immediate earnings opportunities. Furthermore, crafting and selling products can turn hobbies into profitable ventures. Embracing multiple income streams enhances financial security while promoting creativity and resourcefulness.

Success Stories: Broke Millennials Who Overcame Their Struggles

Many broke millennials have transformed their financial situations despite major challenges. Their stories highlight resilience and creativity in navigating a difficult economic landscape.

Inspiring Case Studies

Anna is a standout example. After graduating with $40,000 in student loans, she adopted a strict budgeting plan that prioritized essential expenses. She also turned her passion for photography into a profitable side gig, earning an extra $1,500 monthly. Similarly, Mark saved for a down payment by sharing an apartment and cutting discretionary spending. His dedication led him to buy his first home at age 28, a significant achievement compared to the typical homeownership age of 34. These examples show how determination and strategic planning can shift financial trajectories.

Lessons Learned From Their Journeys

Broke millennials often learn valuable lessons about financial management. Tracking monthly expenses frequently uncovers spending habits that drain budgets. Utilizing various budgeting apps streamlines this process, providing real-time insights. Setting clear financial goals also facilitates prioritization of essentials over luxuries. Many who succeed discover alternative income streams greatly enhance their financial stability. Freelancing and engaging in the gig economy foster creativity while covering living costs. Each lesson reinforces the notion that adaptability within budgeting can lead to financial success.

Broke millennials are redefining financial resilience in a challenging economic landscape. They’re not just surviving; they’re thriving by embracing creativity and resourcefulness. Through strategic budgeting and innovative side hustles, they’re finding ways to enjoy life while managing their financial realities.

The stories of individuals like Anna and Mark serve as powerful reminders that determination and smart planning can lead to significant financial improvements. As this generation continues to navigate their unique challenges, their approach to budgeting and financial management is a testament to their adaptability and strength. With the right tools and mindset, broke millennials can pave their way toward a more secure financial future.